Free rent affordability calculator to let you estimate your monthly affordability based on your annual income and other expenses

Affordable Monthly Rent

More calculators from calculator bank:

- Home affordability calculator

- Student Loan Calculator

- Auto Loan Calculator

- Hourly To Salary Calculator

What's a Rent Affordability Calculator?

Think of a rent affordability calculator as a budget helper that tells you how much you may spend on an apartment or house without going broke. It looks at how much money you make and what you spend it on, then helps you figure out a safe amount for rent. It's pretty much like planning how to spend your allowance - but for grown-up bills!

If you are looking for a new place to live, it's easy to fall in love with an awesome apartment that costs too much. That's where these calculators come into play. They help you make the right choice about where to live based on your actual means.

How Much Rent Can I Really Afford?

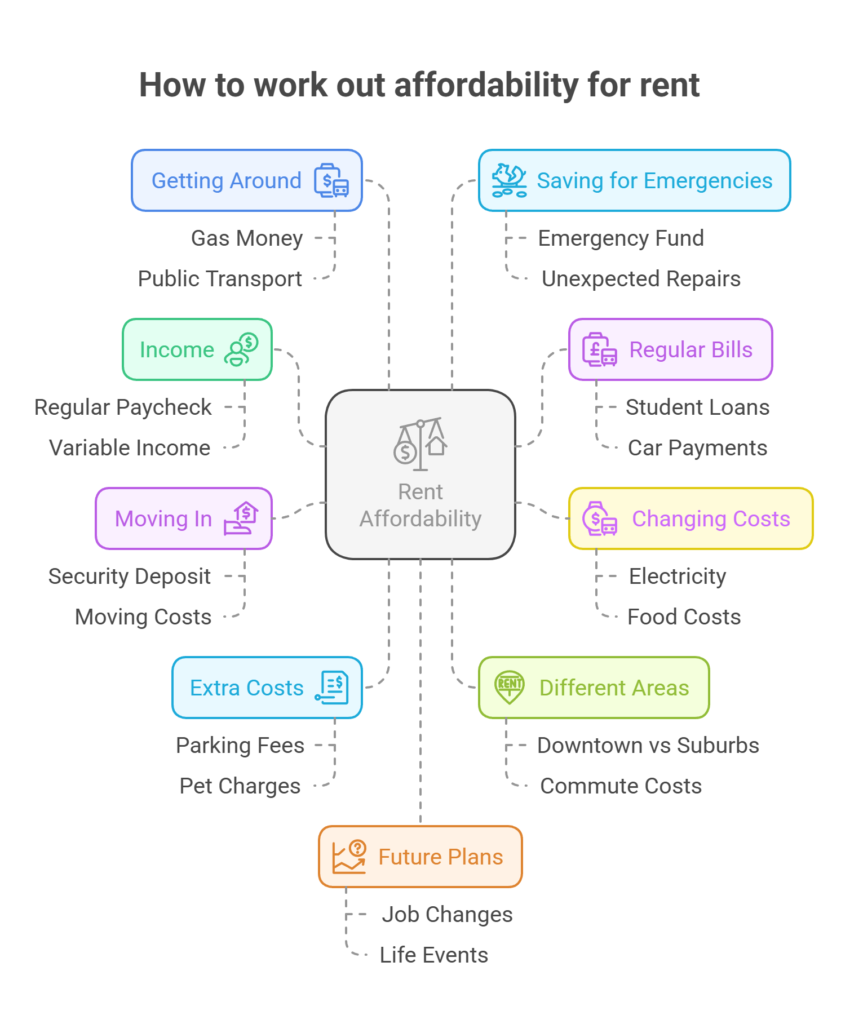

Your Regular Paycheck

Let's talk about the money you make each month or every week. This means your regular paycheck after taxes come out, that's the real money you can spend. If you get tips or extra pay for working overtime, that counts too. The key is knowing exactly how much money goes into your bank account monthly.

When Your Pay Changes

Some jobs do not pay the same amount every month. Maybe you work in sales and get different commissions, or you do freelance work. In that case, look at what you have made over the last 6-12 months and find the average. It's better to guess low than high when planning for rent.

Regular Bills

We all have bills we have to pay no matter what, like student loans, car payments, or phone bills. These come first before thinking about rent. Write down everything you pay for each month that you can't avoid. This helps you see how much is left for rent.

Changing Costs

Some bills change each month, like electricity or gas for your car. Food costs may go up and down, too. Keep track of these expenses for a few months to get a good idea of what you usually spend. This helps you avoid surprises that could make paying rent harder.

Moving In

Renting costs more than just monthly rent. When you first move in, you usually need to pay a security deposit (usually the same as one month's rent) plus moving costs. Don't forget about buying stuff for your new place, like curtains or cleaning supplies and so on.

Extra Costs

Many places may charge extra for things you might not think about, like paying to park your car, having pets, or using the gym in the building. Some buildings even charge extra for trash pickup or maintenance. Make sure you know about all these costs before signing a lease.

Different Areas, Different Prices

Rent prices may be totally different depending on where you live. Living downtown usually costs more than living further out. But also remember, a cheaper place far away might end up costing more when you add in gas money or bus fare to get to work or school.

Getting Around

Think about how you will get to work, school, or other places you go often. If you need to drive everywhere, remember to include gas money in your budget. Sometimes, paying more rent to live closer to where you need to actually save money in the long run.

Saving for Emergencies

Life throws surprises at us sometimes, like car repairs or medical bills. Try to save some money each month for unexpected costs. A good rule is to have enough saved to pay your bills for 3-6 months, just in case something happens.

Future Plans

Think about what might change in the next year or two. Are you planning to switch jobs? Go back to school? Do you expect to have a pet? These changes will affect how much rent you can afford, so plan ahead.

Finding Balance

Your home should be a place where you feel comfortable and safe. While it's important not to spend too much on rent, going too cheap might mean living somewhere that makes you unhappy. Find a middle ground that works for your budget and your lifestyle.

Your Community

Consider what's near your potential new home. Parks, grocery stores, and other places you like to go make a big difference in how much you enjoy where you live. Sometimes it's worth paying a bit more to live in an area you really like.

Putting It All Together

To figure out your ideal rent budget, add up your monthly income, subtract your regular bills and some savings, and see what's left. Most people try to keep rent at about one-third of what they make each month. But everyone's situation is different, what matters is finding an amount that works for you.

Making It Work

Once you know how much you can spend, stick to looking at places in your price range. It's tempting to look at more expensive places, but staying within your budget means less stress about money. Plus, you will have extra cash for fun stuff like going out with friends or saving for something special.

How do landlords calculate rent affordability

Most landlords want renters who earn at least 3 times the monthly rent before taxes. For example, if rent is $1,500, they are looking for someone making $4,500 or more per month. They check this by looking at pay stubs and bank statements and sometimes calling employers.

Many landlords also look at your credit score to see how well you handle money. They might worry if your score is below 650, though this varies by area. They will check if you have a history of paying bills on time and how much debt you're carrying.

How does the 50/30/20 rule help in determining rent affordability

The 50/30/20 rule splits your take-home pay into three parts. 50% goes to needs, and this includes rent, utilities, groceries, and basic bills. Your rent should fit within this 50% along with other essential costs. If rent eats up too much of this chunk, you might struggle to cover other necessities.

30% is for wants, things like dining out, shopping, or entertainment. If your rent is too high, it might steal from this category, leaving you with little enjoyment money.

20% should go to savings and debt payments. This means setting aside money for emergencies and paying off credit cards or loans. High rent can make it tough to save this amount.

For instance, if you bring home $4,000 monthly, you'd have $2,000 for all needs. If utilities and other basics cost $500, you shouldn't spend more than $1,500 on rent. This leaves $1,200 for wants and $800 for savings, creating a healthy money balance.

But don't forget that these aren't strict rules; they are guidelines to help you avoid stretching your budget too thin.